How Nonprofits Can Use Virtual Fundraising During the Coronavirus Crisis

Nonprofits

Delivering the insights needed to achieve your mission.

Fueling Your Cause

Today’s nonprofit organization faces high expectations for transparency, accountability and strong corporate governance. With personal and organizational reputations on the line, you can’t afford to trust your accounting, audit or tax reporting to an inexperienced firm.

As a leader in nonprofit internal audit consulting, Bennett Thrasher serves many nationally known and growing nonprofit organizations in various sectors. These include: hospitals, private foundations, scientific and educational institutions, economic development organizations, charities and social service organizations, professional and trade associations and arts and cultural organizations. We take your organization’s finances as seriously as you do.

Meet Our Nonprofit Experts

Bennett Thrasher believes in serving our clients by building trust through insight and involvement.

If you’re looking for internal audit consulting firms for nonprofits who can help you fulfill your management and government duties, we can help. Contact Alana Mueller or Jennings Pitts to schedule a consultation.

Services We Offer in Nonprofit

We’re not like other nonprofit audit outsourcing firms – we invest time and resources to stay on the cutting edge of nonprofit regulations and accounting guidance. Drawing on our deep technical and industry knowledge, we help nonprofit boards and executives fulfill their fiduciary and governance responsibilities through comprehensive audit, tax and advisory services, including:

- Audits of financial statements in accordance with Generally Accepted Auditing Standards and Government Auditing Standards

- Office of Management and Budget (OMB) Uniform Guidance (single audits) and filing of data correction forms

- Preparing and filing Form 990 federal tax returns

- Consulting on the preparation of required communication from those charged with governance

- Communicating on internal controls related to matters identified during an audit

With our nonprofit internal audit consulting services, you receive close attention from our experienced nonprofit accounting and tax professionals. You can also expect to work with the same team members year after year, so you benefit from their accumulated knowledge of your systems and processes. Our nonprofit team will also meet with your board and management team several times throughout the year to arm you with our insights on your evolving landscape, as well as best practices in governance and internal controls.

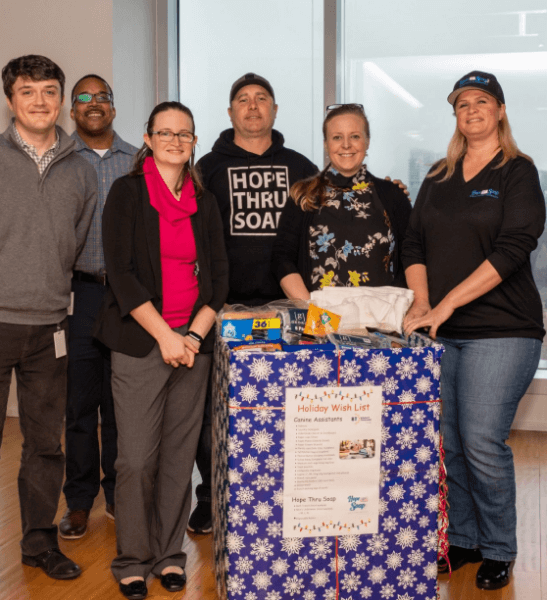

BT Foundation

Just like you, our firm is committed to giving back to our community. Through the Bennett Thrasher Foundation, our partners and associates give their talents, time and gifts to charitable organizations fostering the long-term development and success of individuals in the Greater Atlanta area.

Together with our time and monetary grants, the Foundation is funded from the firm’s top-line revenues. The Bennett Thrasher Foundation is an essential part of the Bennett Thrasher community, not just for the relationships we build between the firm and the community but for the wealth of opportunities it creates for us to give back.

Trusted by Many

“The transfer pricing audit ended after the German tax authorities reviewed our Local File. It might have been the best money I have ever spent.” – Feedback from Finance Director of Irish Multinational in Healthcare Industry following a transfer pricing audit in Germany

“Ben and his staff have been fantastic. They have been very professional and extremely patient as we navigate through our transaction and the planning process.”

“We are incredibly grateful for the partnership, support and collaboration of you and your team…Your professionalism and collaboration truly made the difference for the Company, our teams and our leaders.”

“As always, we very much appreciate your hard work and the hard work of the entire BT team.”

“In the past, I have used two of the top four national accounting firms for advice. I have found Jeff Call’s firm Bennett Thrasher, the most responsive, always available and very, very helpful. Once I’m not around, I’m certain my state trustee will continue to rely on Jeff’s firm.”

“Bennett Thrasher provided exceptional second mile audit services for Trilith Studios. Their team was thorough, knowledgeable, demonstrated a high level of attention to detail and provided clear communication throughout the entire process. We highly appreciated their collaboration and the professional service they provided throughout the entire audit process.”

“Just when you have self-assessed your company to possibly be the worst client ever, the Staff at Bennett Thrasher make you feel like you are their most important and beloved client. That ability is an attribute you don’t see in many accounting firms.”